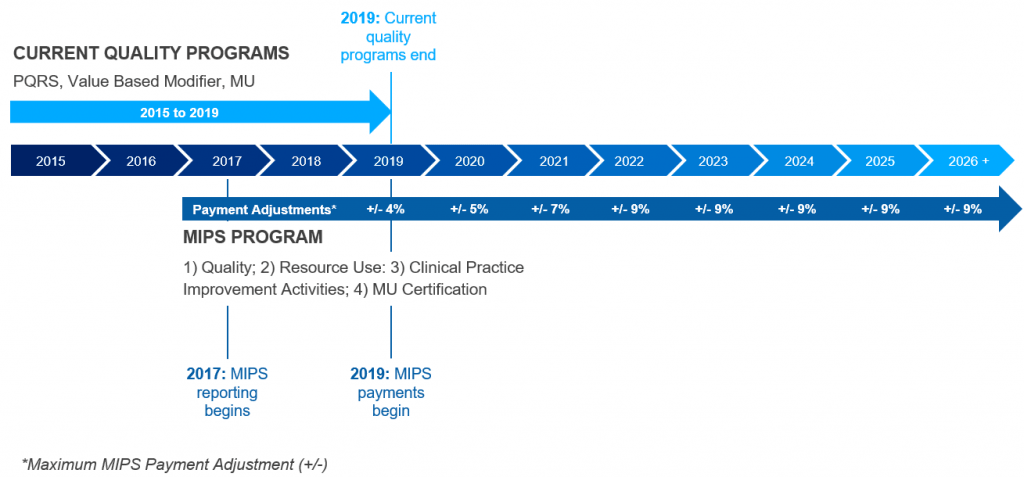

QPP, MACRA, MIPS and APM Timeline Chart and Graph

The Centers for Medicare and Medicaid Services (CMS) released the final rule that will implement the Quality Payment Program (QPP) as part of the Medicare Access and CHIP Reauthorization Act of 2015 (MACRA). Although the QPP will still begin January 1 2017, there will be a ramp-up period with less financial risk for eligible clinicians in at least the first two years of the program. Read more about the four things you need to know about the final rule as it relates to QPP participation in 2017.

What should I be doing now to get ready for QPP?

The best way to get ready for QPP, MACRA and MIPS is to satisfy Meaningful Use Stage 2 requirements and continue to work on meeting Clinical Quality Measures. CMS has stated that those providers already attesting to Meaningful Use and PQRS will likely have no net new requirements.

Learn more about how to get ready for QPP and MACRA »

| Year | QPP, MACRA, MIPS and APM Timeline |

|---|---|

| 2015 | Medicare Access and CHIP Reauthorization Act of 2015 (MACRA) legislation passed and RFI public comments submitted to CMS. |

| 2016 | QPP Proposed and Final Rule released. |

| 2017 | MIPS first performance year begins. Multiple reporting options for providers allow them to pick an option that works best for their practices. Options to avoid a negative payment adjustment include reporting some data, a 90 day reporting period, and a full year reporting period. MIPS payment adjustments in 2019 will be based on performance in 2017. |

| 01/01/2017 | Providers who are ready to begin participating in the programs can start collecting performance data on Jan. 1, 2017 and could result in a positive payment adjustment. MIPS payment adjustments in 2019 will be based on performance in 2017. |

| 10/02/2017 | Providers who are not yet prepared to participate have until Oct. 2, 2017, to begin collecting performance data and still could qualify for a small positive payment adjustment. MIPS payment adjustments in 2019 will be based on performance in 2017. |

| 01/01/2018 | The performance period for MIPS is the full calendar year (Jan. 1 through Dec. 31) two years prior to the payment adjustment year. As such, MIPS payment adjustments in 2020 will be based on performance in 2019. 2018 reporting requirements are subject to change, and CMS will release more information in 2017. |

| 03/31/2018 | Participating providers must submit all data, regardless of when collection began in 2017, to CMS by March 31, 2018. |

| 12/31/2018 | MU, PQRS and VBM payment adjustments sunset for Medicare providers at the end of 2018. |

| 2019 | MIPS Payment Adjustment (+/-) 4% plus up to a 12% bonus for achieving 25th percentile or Qualifying APM 5% Participant Incentive Payment. |

| 2020 | MIPS Payment Adjustment (+/-) 5% plus up to a 15% bonus for achieving 25th percentile or Qualifying APM 5% Participant Incentive Payment. |

| 2021 | MIPS Payment Adjustment (+/-) 7% plus up to a 21% bonus for achieving 25th percentile or Qualifying APM 5% Participant Incentive Payment. |

| 2022 | MIPS Payment Adjustment (+/-) 9% plus up to a 27% bonus for achieving 25th percentile or Qualifying APM 5% Participant Incentive Payment. |